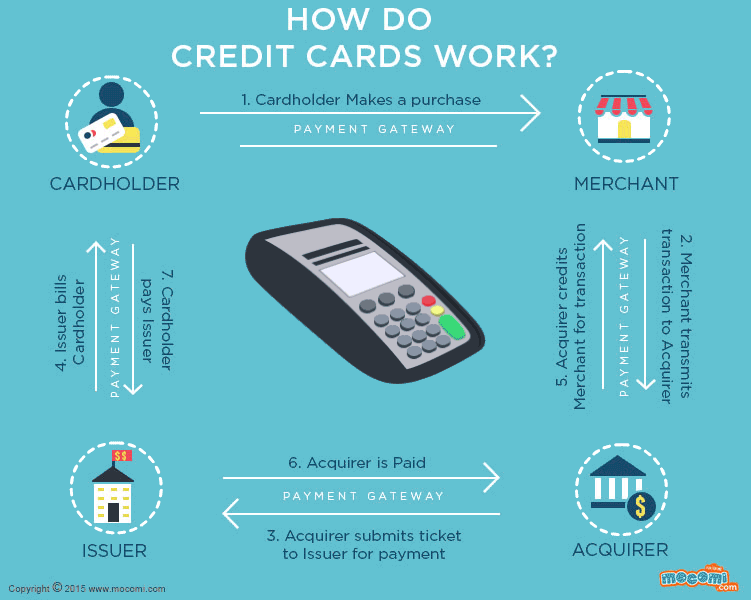

Having multiple credit cards allows you to be more convenient when it comes to paying your bills. Not only that, but they also help improve your credit score. In fact, a lot of people use their credit cards to pay for gas, groceries, and other items that they are not likely to be able to afford with one single card. Besides that, having several accounts can help you avoid delinquency, and it can also help you track your expenses.

Two to three accounts at a time

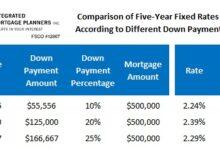

One of the perks of being an adult in Canada is the availability of more than a handful of credit cards. The average Canadian has more than two cards, according to the Canadian Banking Association. While more credit cards in your wallet doesn’t necessarily mean more spending, it does mean more responsibility for you to keep track of. You may be surprised to find that a card with a high limit could cost you as much as a monthly mortgage payment.

There are other factors to consider, like how often you will be using your card, how you will use it and whether or not you will pay it off in full each month. To make things easier on you, you should consider obtaining a card with a low interest rate, as long as you can make the payments on time. A good rule of thumb is to never use your card to purchase any goods or services that you do not plan on paying for in full.

Convenience

When it comes to choosing the right credit card to meet your needs, you need to look at your situation, budget and goals. There are many good credit cards out there, but some are more useful than others. The American Express Cobalt is one of the better ones for dining, but not all restaurants will accept it. In fact, it is not accepted at all in some parts of Canada. Getting more than one is a great way to increase your buying power.

If you have multiple cards, you need to make sure you can pay off each one on time, every time. Also, you should consider which credit cards are accepted at the merchant’s store. Some retailers charge shoppers for swiping their credit cards.

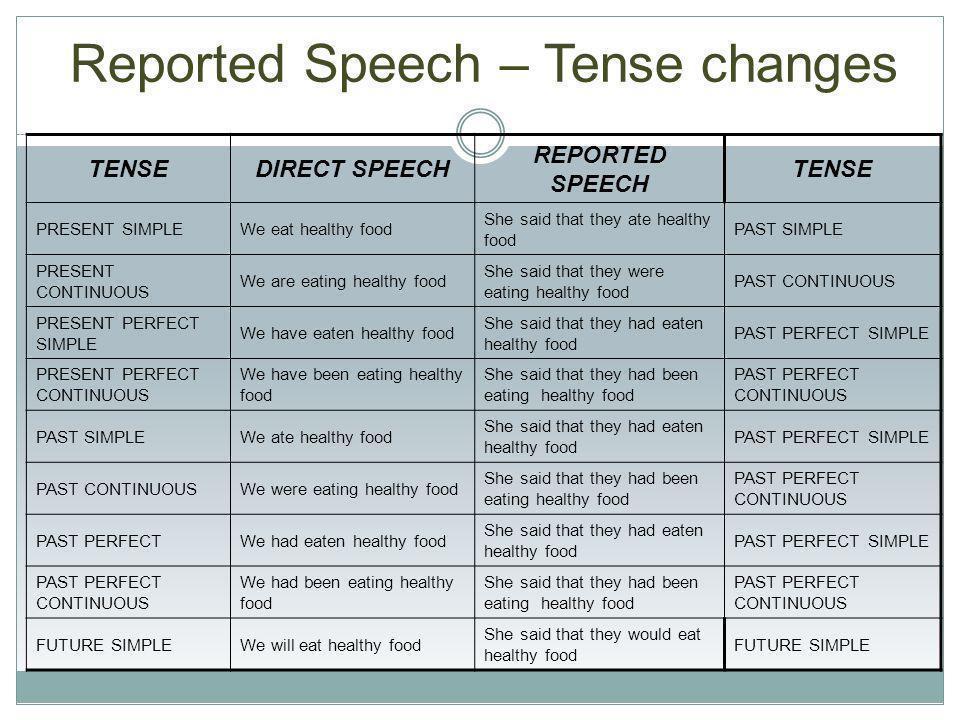

Expense tracking

If you are using credit cards for your business, you need to make sure you are tracking the expenses you are making. This will help you avoid any credit card fraud, as well as keep track of all your purchases. While it may seem like an intimidating task, it really doesn’t have to take a long time. There are apps that can make this process easier.

Expensify is a great option for a mobile expense report. It automatically reads your receipts and converts them into expenses. You can also take pictures of the receipts to add to your expense report. After a six-week free trial, you can use the app as much as you want. As a bonus, you can also access reports from the past and present to see how your financial decisions have impacted your company.

Credit rating improvement

One of the most effective ways of improving your credit rating is to have more than one credit card. The number of cards you have is a personal decision, but you should have more than one if you can manage it. It is also important to monitor your spending. If you are prone to missing payments, consider establishing an alert so that you will know when a bill is due.

A credit score is a three-digit number that represents how well you’ve managed your credit in the past. You should check your credit report to see if there are any inaccuracies or other problems that may be affecting your score.

There are several factors that determine your credit score. The length of your credit history is one of the most important. Other factors include the length of time you have been using your credit, the type of credit, and the amount of credit you currently have.

Avoiding delinquency

If you are struggling with a credit card that is delinquent, there are ways to get the account back on track. Using a certified credit counselor can help you create a plan to resolve the issue and get your finances on track.

A credit card’s grace period is typically 30 days. This gives you time to make up for missed payments. However, if you are delinquent for more than 30 days, your account could be suspended. The creditor may also impose penalties and fees.

If you want to avoid delinquency with your credit cards, pay your balance in full each month. This allows you to avoid late fees and interest. It also keeps your account in good standing.

Generally, a creditor will not report an account as delinquent until two consecutive payments are made. If you are behind, contact your creditor to ask for a new payment schedule.