Are cash gifts taxable in Canada? There is no clear answer to this question, and your taxes can vary depending on how you make your gifts. For example, gifts that you give to a spouse can be tax-free, while those that you give to a family member may be taxable. The key is to be careful with what you give.

Non-cash gifts

There are certain things that you need to know when it comes to gifts and the Canadian income tax. If you have a gift or are thinking about giving one, it is always a good idea to consult a tax professional. Often, the government will ask you to prove the origin of the gift. You can get more information on the Canadian Income Tax website.

Non-cash gifts are gifts that do not involve the transfer of cash or goods and services. Examples of non-cash gifts include vouchers for specific items, tickets to special events and other gifts that do not include the transfer of property.

Gifts that are not taxable in Canada are generally those that are given for special occasions, like birthdays or holidays. Some examples of these events are religious holidays, public holidays, milestones and personal events.

Cash or near-cash gifts, however, are taxable. If you are thinking about giving a gift to an employee, it is best to talk to a qualified accounting or tax professional. In some cases, the cost of the gift can be deducted from the employee’s salary.

Gifts of property

When you receive or give a gift, you may wonder if it will be taxed in Canada. If you are concerned about taxes, there are some things you can do to avoid any problems.

Gifts in Canada are generally tax free, although there are certain rules to follow. You can also make use of the income splitting rule to reduce your tax burden.

Generally, gifts are considered to be taxable only if you receive them from an employer. Employees are allowed to receive up to $500 in non-cash gifts annually.

If you are considering making a gift to a family member or friend, there are some important tax rules to follow. Generally, the amount of the gift will not be taxable to the receiver, but you will be responsible for any future income on the gifted amount. However, there are ways to protect the money if the recipient is married or has children.

Attribution rules

If you have been considering making cash gifts in Canada, there are several things you should know about the tax rules. It can be helpful to get advice from a Chartered Professional Accountant who can help you avoid problems. You may also want to establish a family trust.

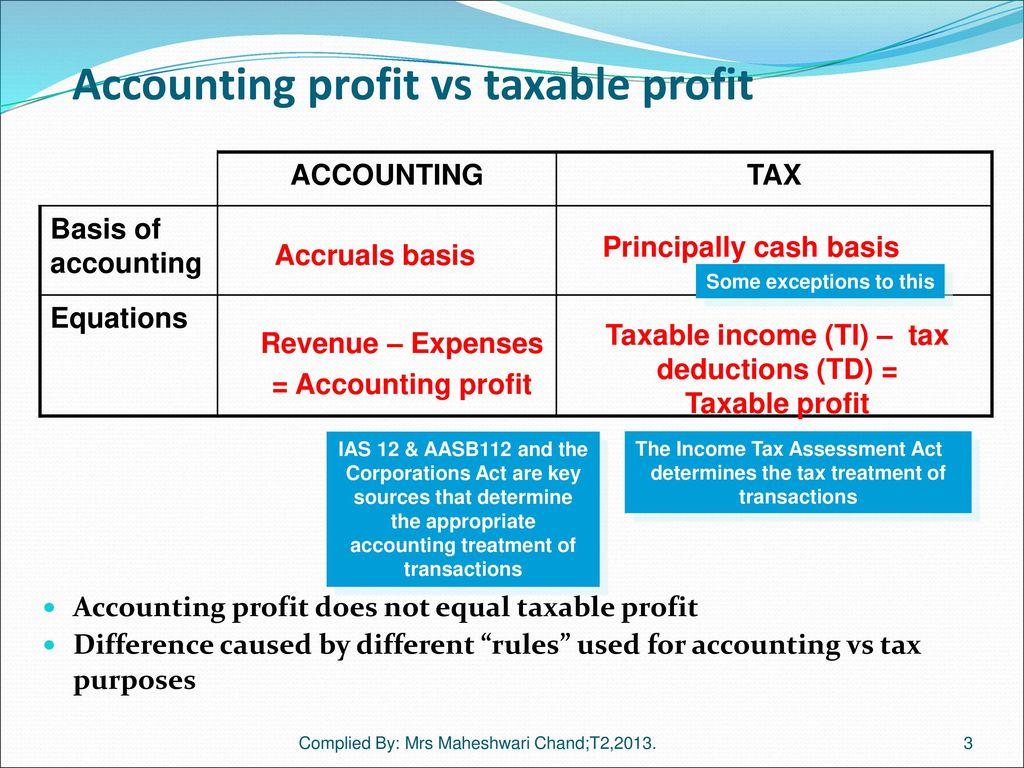

Tax-attribution rules are designed to prevent taxpayers from shifting investment income to family members. However, these rules can also prevent families from reducing their tax burden. By spreading income around the family, you can lower your overall tax bill.

Fortunately, attribution rules do not apply to all transfers. Instead, specialized rules exist for some situations. These rules are included in the Income Tax Act.

For example, if you make a guaranteed loan to a spouse, you must apply attribution rules to any income earned from the loan. Also, if you make a loan to a child, you must apply attribution rules to any money the child receives from the loan.

Cross-border tax planning

Whether you are a donor or donee, there are many aspects of cross-border tax planning that can have a significant impact on your life. The complexity of these matters requires experienced and qualified advice. If you are considering giving or receiving a cash gift, you should speak to a tax attorney with cross-border experience to determine how these matters apply to you.

For example, a Canadian snowbird who owns a U.S. vacation home may be at risk for double taxation. This occurs when the unrealized appreciation at the time of the gift triggers a capital gains tax for the donee’s father in the U.S.

However, there are ways to minimize the risk of a double taxation situation. A deferral of taxes is one way to achieve this. It can provide a significant advantage, but only in certain situations.

In addition to the gift tax, there is the estate tax. The estate tax is also referred to as the generation-skipping transfer tax. Generally, this tax applies to assets you have owned for five years or longer. You can elect to accelerate the tax when you die.