When you go to apply for a loan, you might want to check your credit score. This is not only a good idea if you are thinking of buying a car or home, but it is also a great way to protect yourself against credit card companies that might try to scam you. Before you do anything, be sure to read this article to learn the differences between a soft and hard credit check.

Soft vs hard credit check

There are two types of inquiries that are commonly done, a hard inquiry and a soft inquiry. The difference between the two is fairly simple, but it is important to know which one you are dealing with to avoid damaging your credit score.

A hard inquiry is an official review of your credit file. It is triggered when a lender or other third party requests your report. This may occur when you apply for a new loan, line of credit, or another type of financial product.

On the other hand, a soft inquiry occurs when a business looks at your credit report without requesting your credit. These kinds of inquiries aren’t a big deal, but they do show up on your credit report.

If you are looking to get a new line of credit, it is a good idea to understand the differences between these two types of inquiries. While a hard inquiry may cause a small dip in your score, a soft inquiry won’t.

Another important difference is the length of time that these reports stay on your credit file. A hard inquiry will be on your file for a full year.

Unlike a hard inquiry, a soft inquiry doesn’t stay on your report for more than 24 months. You can remove a soft inquiry if you want to improve your credit, but you’ll want to make sure to do it right the first time.

Canadian laws require written consent to check your credit report

The Canadian government’s privacy and data protection laws are amongst the most stringent in North America. If your organization’s name isn’t on the dotted line, you may well be subjected to the wrath of the federal government’s digital axe. Luckily, you can avoid the jawdrops of disbelief by implementing some sound business practices. A little diligence and a little elbow grease go a long way in ensuring the success of your organization.

To make the most of the best possible outcomes, it’s not a bad idea to implement a few savvy privacy policies. For starters, you should ensure that you don’t have to worry about your credit card number, social security number, or the like being accessed by third parties, which may be in the employ of your competitors. It’s also worth noting that, while it’s not always possible, you might want to find out if your current employer is considering moving you on to the next rung of the corporate ladder. You can do this by requesting a copy of your credit report from your current employer, as well as by obtaining a free copy of the credit report from your current employer.

Similarly, it’s not a bad idea if you’re in the market for a new apartment or a new house to ask your prospective landlord if they would be willing to let you check out their building’s inventory of kitchen appliances. As a bonus, you can also ask about their tenant rating – a surprisingly large number of landlords are not a fan of tenant complaint letters.

Common reasons to check your credit score before applying for loans

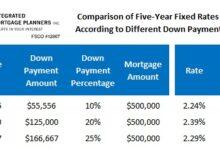

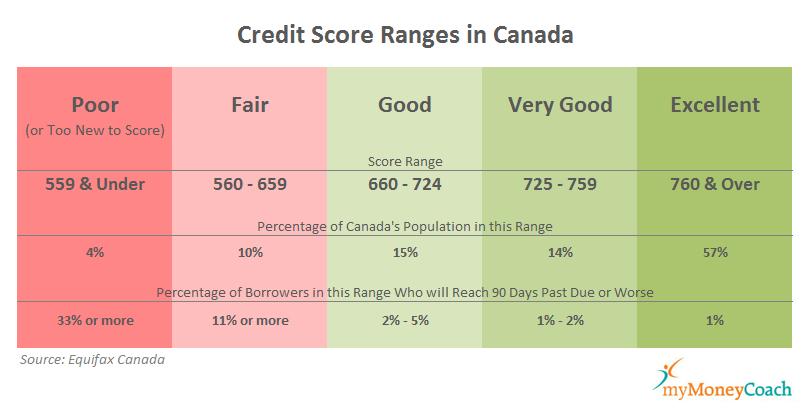

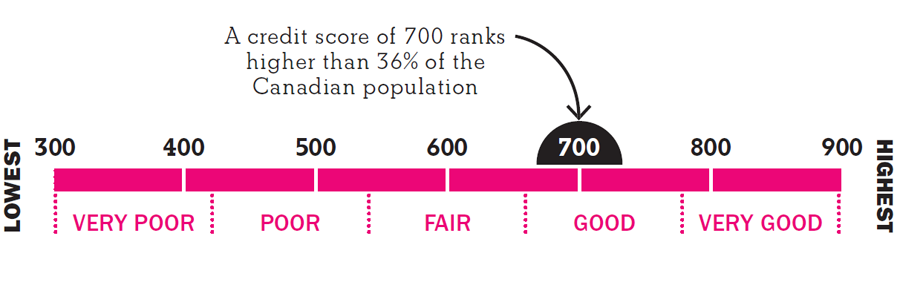

A credit score can make or break your chances of getting a loan. It can determine what types of loans you qualify for, the interest rates you pay, and the terms of the loan.

Credit scores are based on information from credit reports. The three major nationwide consumer reporting agencies – Experian, TransUnion, and Equifax – collect and report credit history information. They provide free credit reports to people once a year.

Having a good credit score means having a history of regular payments on time. If you have a history of missed payments or accounts in collections, your credit score can be low. That’s why it’s so important to stay on top of your bills. Make sure your credit report is accurate, and report any errors right away.

A high credit utilization ratio is another factor that can affect your score. This is measured by the amount of spending on your credit card compared to your total credit limit. Lowering your credit usage will show lenders that you are financially responsible.

There are several other things that lenders look at when assessing your credit. Payment history counts for 35 percent of your score. Late payments, a history of accounts in collections, and derogatory marks on your credit report all contribute to your score.