If you are looking to check your credit score in Canada, you are in the right place. The most commonly used credit reporting companies in Canada are Equifax, TransUnion and Scotiabank. All three of these companies are extremely reliable in terms of providing you with the information you need to assess your current credit standing.

Equifax

If you’re wondering how to check my credit score Canada, you should know that it’s easy. Using Equifax’s online service, you can see your credit report, including your scores, for free. This information can be helpful when you need to apply for a loan, and it can also protect you from identity theft.

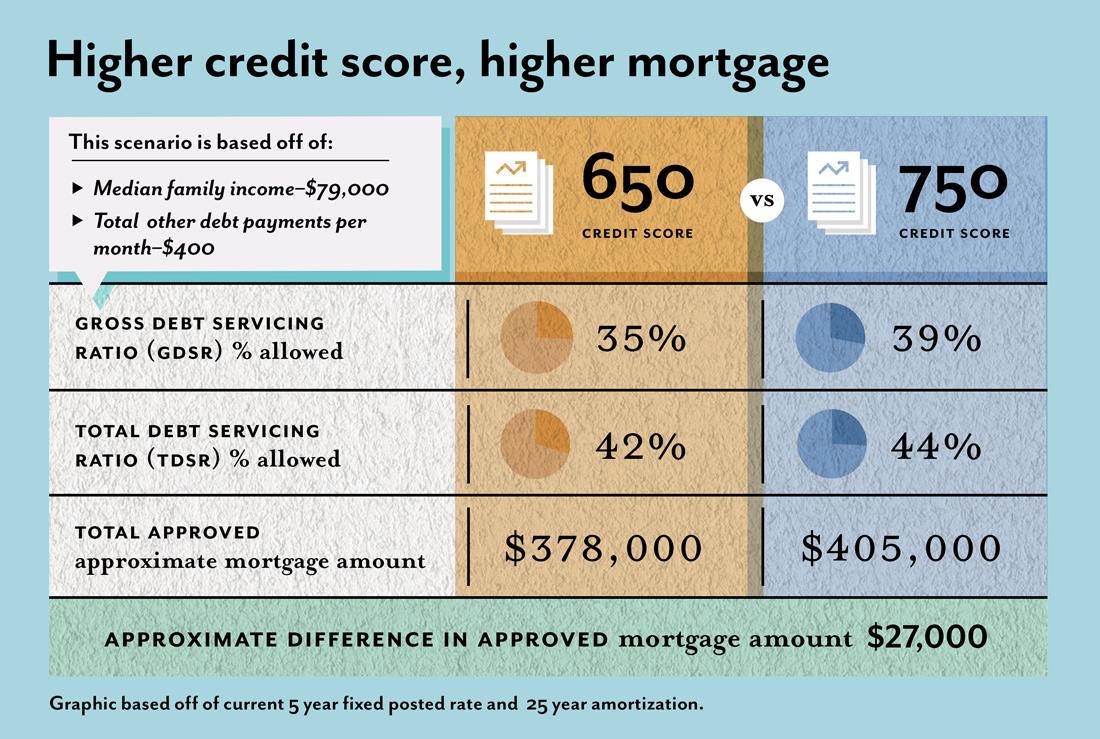

Credit reports are one of the main tools lenders use to determine whether you’re a good risk. They estimate how much interest you’ll pay, and how much you’ll be able to borrow. When you’re looking for a mortgage, a car, or other major purchases, knowing your credit history can help you make wise financial decisions.

Many banks, employers, landlords, and other institutions are required to check your credit score. The federal government also recommends that you get your credit report and score to ensure it’s accurate.

Equifax, one of the three major credit bureaus, provides free credit scores for consumers. However, an error caused by the company resulted in the misreporting of scores on millions of Americans.

TransUnion

If you’re looking to check your credit score in Canada, you’ll want to know which credit bureaus you can use. Fortunately, there are many options available.

The credit reporting agency TransUnion offers a free online credit report. It also offers innovative credit monitoring services that can spot mistakes or blemishes on your report.

In order to access your free TransUnion credit report, you’ll need to provide your Social Security number (SIN), date of birth and address. You can also sign up for a Credit Karma account, which uses your TransUnion credit report to provide you with credit card offers based on your credit score.

Another option is to request a TransUnion credit report by mail. You can also request a report in person, over the phone, or through your banking app. Depending on the type of report you choose, the process can take several days.

TransUnion is a global information and insights company that uses proprietary formulas to create your credit score. You’ll need to read the terms of service for the TransUnion Credit Score service, which you can find here.

Scotiabank

You can easily check your credit score Canada with Scotiabank. This service is offered at no additional cost. The credit score can be obtained through online banking.

Credit scores can help you to qualify for mortgages and low interest rates on loans. In addition, it can help you to identify good financial habits and find errors in your credit profile.

To ensure you have a strong credit history in Canada, you should pay your bills on time. Avoid maxing out your credit limits. Instead, try to limit spending to less than 35 per cent of your total credit line.

Using a credit card for small purchases can help you build a strong credit history. However, you should avoid applying for multiple cards. When a newcomer arrives in Canada, he or she should try to stick with one card and keep the balance paid off.

Credit bureaus like Equifax and TransUnion collect information on people’s credit and loan payments. Lenders review these reports and use the information to determine your creditworthiness. If your report shows inaccurate information, it will affect your ability to get loans or lines of credit.

Is 850 a good credit score in Canada?

Getting a credit score in Canada is a good idea for anyone who is trying to build a credit history. A high score will get you approved for better loans and interest rates, as well as help you secure a better credit card. Whether you’re trying to buy a car or open a business, a strong credit score can save you thousands of dollars in interest over the life of your loan.

One of the best ways to improve your credit score is to pay off your debt. In addition, you’ll want to keep your credit utilization rate low. If you’ve made all of your payments on time, a lender will consider you to be a reliable borrower.

While you’re at it, it may be a good idea to look into a secured credit line. Banks and credit unions offer these lines of credit, but you’ll need to put money up front to start. This can improve your credit score quickly.