If you’re looking to raise your credit score, you’ll want to know about the best ways to do it. The following article will explore some of the most important aspects of credit repair, including paying your bills on time, keeping your debts paid in full, and reviewing your credit reports. We’ll also talk about ways to rebuild your credit after bankruptcy, and offer tips to help you keep your credit utilization low.

Paying bills on time

Paying bills on time can be a pain in the patootie. One way around this is to create a budget for your credit card expenditures, which is a smart way to avoid the dreaded late fee. A little finesse and frugality can go a long way in improving your credit score and your bank account. As a matter of fact, the best thing about this new approach is that you’ll be able to reap the rewards in the form of a more streamlined bill payment experience. Plus, you can bet that you’ll be rewarded with a much higher credit limit in the process. This will allow you to start building your credit portfolio and make the leap from the dark side to the light side in a timely manner.

Reviewing credit reports

If you’re looking for a boost to your credit score, your best bet is to do your homework. Fortunately, there is a wealth of advice out there that should make the task easier than figuring out which cab to take. The trick is to determine which bank, lender, or service provider will give you the best rate. In some cases, you may need to visit a number of lenders before you find a match. While this isn’t ideal, it is far better than getting stuck with a bad bill. A good rule of thumb is to apply for credit at least once a month. By keeping tabs on your credit history you’re less likely to slip up in the future.

Keeping credit utilization low

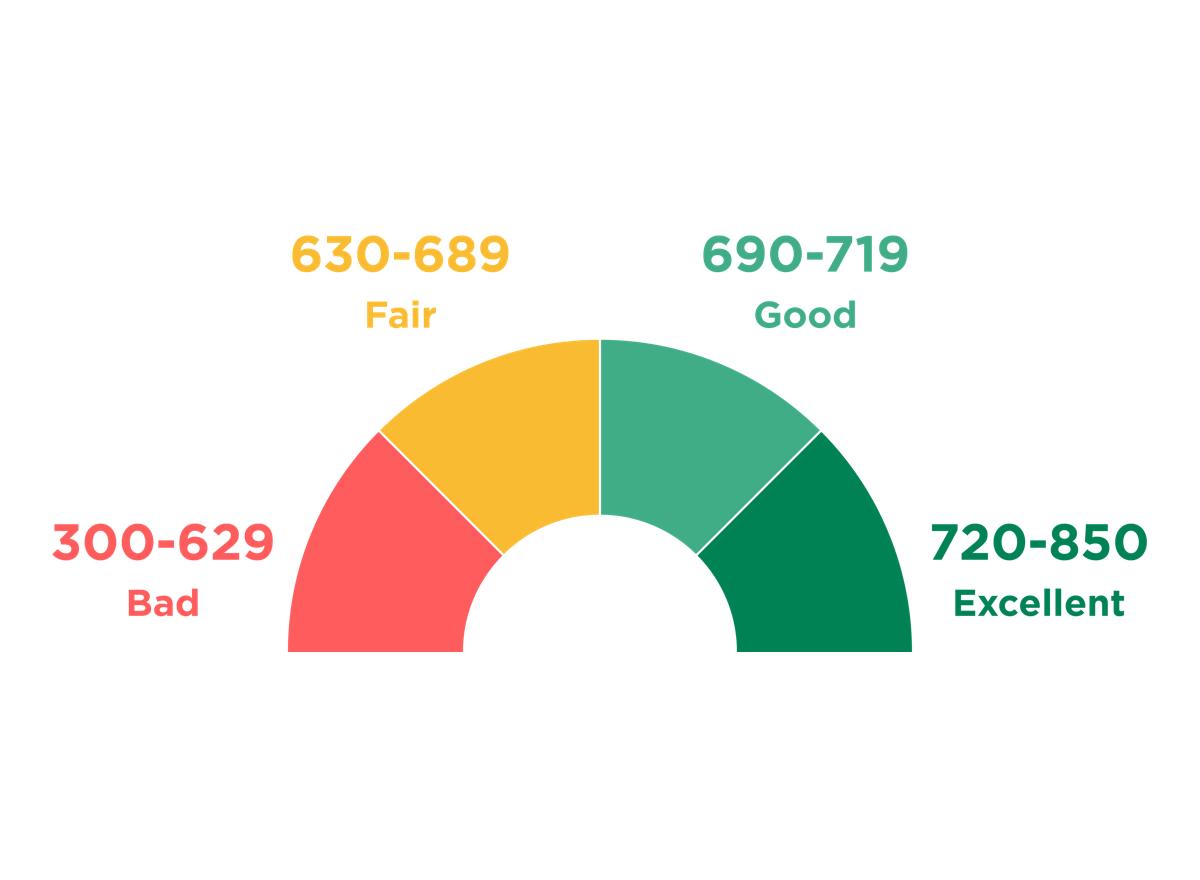

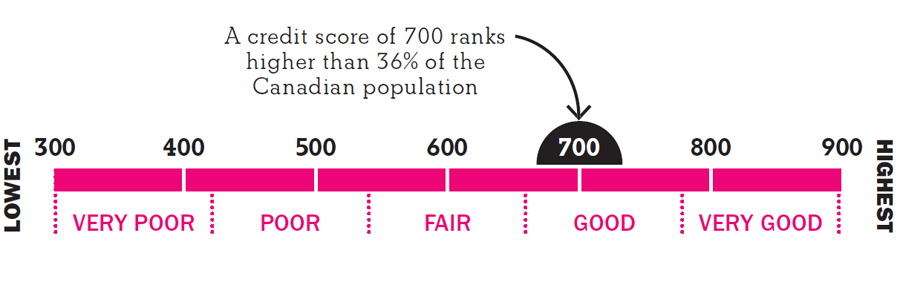

If you’re trying to improve your credit score in Canada, the first thing to do is stay on top of your credit utilization. This ratio is the percentage of your available revolving credit that you are using. In the long run, keeping your credit utilization low will help you to raise your credit score.

You can lower your utilization ratio by making payments on time and paying down the balances. Paying off your balances before the due date also helps you to avoid interest charges.

Another way to decrease your utilization ratio is to increase your credit limit. You can do this by contacting your lender. It’s important to stay on top of your payments, though, because missed payments can hurt your credit score.

Rebuilding credit after bankruptcy

If you have filed for bankruptcy, you may have a lot of debts that you can no longer afford. However, there are things you can do to restore your credit. Fortunately, rebuilding credit after bankruptcy isn’t impossible, as long as you know the steps.

First, you should try to get your finances in order. This means setting up an emergency fund. You can use this money to cover expenses such as unexpected emergencies or high-interest debts. A small fund is fine for now, but make sure to add to it as you can.

The next step is to consider secured loans. These are loans that require a deposit. Secured loans are easier to obtain after a bankruptcy, and can help diversify your credit.